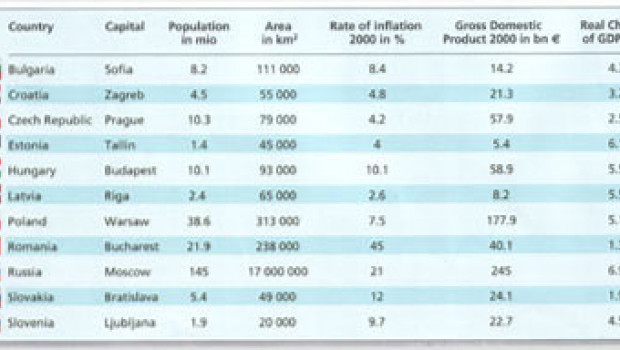

The competitive situation in central and eastern Europe is intensifying as internationally active DIY multiples from countries of the west continue to expand

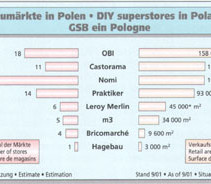

Poland

OBI is the market leader in Poland in terms of retail area. The company has invested a great deal in expansion since its market entry in 1998, especially last year. Today OBI has 18 DIY superstores and is planning further new openings at Olsztyn and Opole among other locations.

Last year saw Praktiker open four stores in Poland, which brought its total count to 14. Planned for the fourth quarter of this current year is one new opening each in Krakow and Gdansk. The group will be celebrating the Gdansk store as its 50th location abroad. Praktiker intends to operate 25 stores in Poland altogether.

Three new openings meant Castorama was able to increase its number of stores from 8 to 11 this year. There are plans for an outlet at Czestochowa in the first quarter of 2002. The company intends to have a total of 16 stores in Poland by the end of 2002.

Nomi, the DIY chain that is part of the Kingfisher group, currently operates 32 stores consequent to eight new openings last year. So far this year has seen no continuation of the expansionary process.

Following two new openings this year (Poznan and Bialystok), Leroy Merlin now has six DIY superstores. Last year the Bricomarché chain, which also comes from France, moved into the Polish DIY business as well; the company already has four locations to its name.

Last year the Bürger group, a voluntary member of Hagebau, opened a first DIY store in Poland. Hagebau is reckoning with members of the voluntary group opening two to three outlets in Poland both this year and next. Activities there in collaboration with Bricomarché are also a possibility. Both companies are already working together on the buying front with the help of their joint subsidiary Arena.

The Polish chain Komfort S.A. of Szcecin has approximately 100 specialist stores (with an average retail area of 700 m2) which concentrate especially on selling floor and wall coverings. Under the "m3" format the group operates five stores with retail areas of up to 9 000 m2 that stock a considerably expanded product mix covering everything necessary for the home and garden.

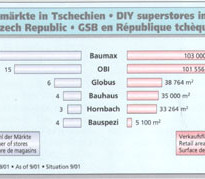

Czech Republic

In 2000 Baumax opened three new branches in the Czech Republic and the store network is to be extended by another three outlets this year as well (Hradec Kralove, Most and Ostrava). Within the next three years Baumax intends to create ten new locations in the Czech Republic.

OBI inaugurated two new stores last year and, after one new opening at Prague in May of this year (11 000 m2), its total number of locations increased to 15. New stores are envisaged for Prague (12 000 m2) and Ostrava (10 000 m2) by April 2002.

The last time Globus opened any DIY stores in the Czech Republic was 1999, when three were inaugurated. There the company is following a new concept, which entails the creation solely of hypermarkets in conjunction with DIY departments and garden centre sections on areas of up to

5 000 m2, since it is expected that higher sales per square metre can be achieved by such a combination.

The last time Bauhaus was active in the Czech Republic was also 1999, when it opened one new store, though another Bauhaus is to be inaugurated in Prague in 2002.

Hornbach is not displaying any ambition to expand its network of branches in the Czech Republic for the time being. The latest new opening occurred in the autumn of last year, and no new outlet has been announced for 2001.

Four DIY locations now operate under the Bauspezi logo following the opening of a DIY store with builder centre at Prostejov in September of this year. Six or seven more Bauspezis are scheduled for the Czech Republic.

Slovakia

Baumax operates six locations in Slovakia, and the Austrian company is planning to expand considerably here as well. The intention is to double its network from six stores to twelve by 2003. Plans for this year include a second store at Kosice, and another Baumax with a sales area of 10 000 m2 is to open in the capital, Bratislava. This will be the group's third location in the Slovakian metropolis.

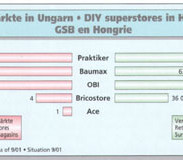

Hungary

After two new openings in the fourth quarter of 2000, Praktiker ended the year with eleven stores and, following one new opening this year (at Szombathely), was able to further consolidate its market leadership in terms of retail area. A store is to open at Budapest before this current year is out.

Baumax operates twelve stores in Hungary. This year the programme includes store extensions: the additional floorspace will come to more than 22 000 m2, according to Baumax. OBI, with its eleven DIY stores in Hungary, has announced one new store for this year in Budapest.

Bricostore has a four-store presence in Hungary with the most recent new opening taking place last year. The French-based group has announced the opening of two new locations this year and intends to operate twelve DIY superstores altogether in Hungary.

Slovenia, Croatia, Bulgaria and Romania

In Slovenia Baumax has three stores and plans to operate five locations by 2003. OBI opened its first outlet there last year, and Bauhaus also has a one-store presence in the country.

In Croatia a first store was inaugurated by Baumax at Varazdin in December 2000, while at the same time Bauhaus started up its first Croatian branch at Zagreb. Baumax is planning to open five new locations in Croatia by 2003.

Bulgaria saw Mr. Bricolage gain a foothold in the country last year, operating one location in Sofia on a retail area of 2 000 m2. The opening of another store (3 500 m2) is scheduled for the end of this year.

Romania is proving to be of interest to Bricostore, which is planning to establish a DIY superstore of 9 000 m2 in Bucharest. Construction work started in May of this year.

The Romanian DIY retailer Brico has been active since September 2000 and has one outlet of 3 200 m2 at Cluj-Mapoca. This autumn should see the opening of a second location at Bucharest, and a third store has been announced for next year.

Baumax is also showing interest in the markets of Romania, Bulgaria and Serbia.

Estonia and Latvia

Since last year the Finnish retail group Kesko has been operating its DIY marketing format K-Rauta in the two Baltic states of Estonia and Latvia. It operates four DIY stores in Estonia, two at Tallinn and one each at Tartu and Pärnu. Next year should see the opening of a further location in Tallinn with a floorspace of approximately 10 000 m2, and the Pärnu store is to be extended from the current 2 480 m2 to 5 700 m2.

In the Latvian capital of Riga a store of 8 500 m2 is operated by Kesko. In the spring of 2002 two further outlets are to open there, one boasting a retail area of 8 000 m2. The product mix of the Baltic K-Rauta stores is essentially the same as that available in Finland, though special local features and requests were taken into consideration when putting it together.

OBI too is active in Latvia, opening its first DIY superstore of 7 400 m2 in Riga at the end of September this year.

Vincents is a Latvian company that has been operating a DIY store by the name of Centrex at Riga since late 1998. This has a retail area of 3 500 m2 with an outdoor area of about 850 m2 for garden products. The product range includes far in excess of 20 000 items. It is intended to add a garden centre to the DIY store, with a glasshouse included as part of the sales area.

Russia

Kesko operates one building materials store in Moscow (1 200 m2). There are no concrete plans for expansion in Russia, but the intention is to observe the market situation closely.

In the spring of 2002 AVA is planning to open a shopping centre in Moscow that will include a hypermarket, a DIY store and specialist shops, provided that the authorisation procedures are completed without delay.

Management at Bauhaus as well is fundamentally interested in Russia and Ukraine and is giving consideration to the idea of getting in there too.

DIY in Europe 9-10/2001