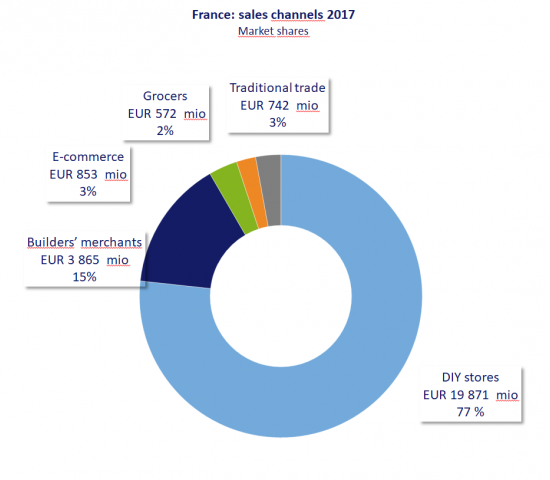

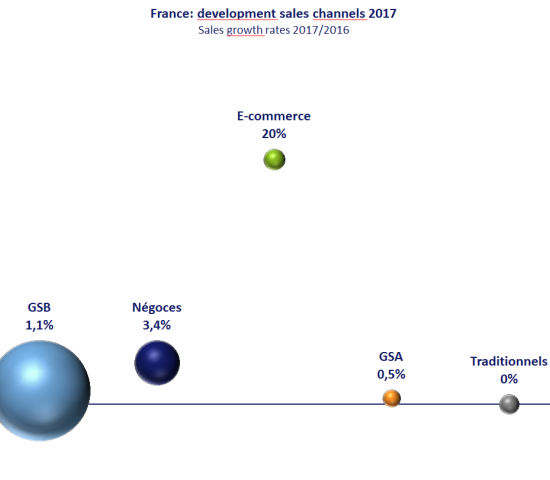

The star performer among the distribution channels was the building materials segment, in which sales rose by 3.4 per cent to EUR 3.865 bn and which has a 15 per cent share of the market. It goes without saying that e-commerce, meaning the pure players in this instance, experienced significant growth of 20 per cent, but its market share is still relatively small at 3 per cent.

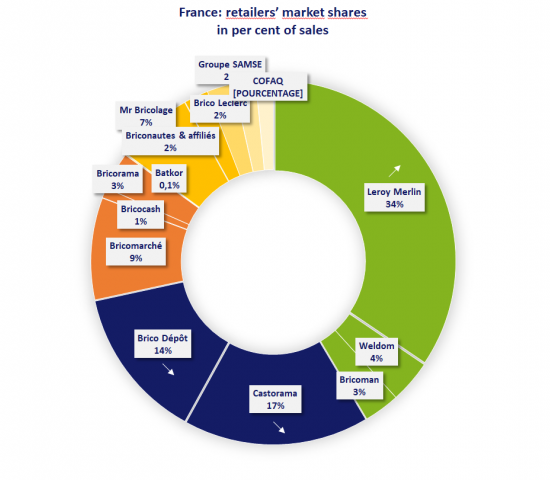

In the store chain segment, market leader Leroy Merlin of Groupe Adeo consolidated its position and increased its market share by one per cent to 34 per cent. Castorama and Brico Dépôt, the two French distribution lines of the British Kingfisher Group, retained their market shares of 17 and 14 per cent respectively, but have lost ground, according to information from the retailers' association. Market share was surrendered by Bricomarché (down one point to 9 per cent) and Mr. Bricolage (down three points to 7 per cent).

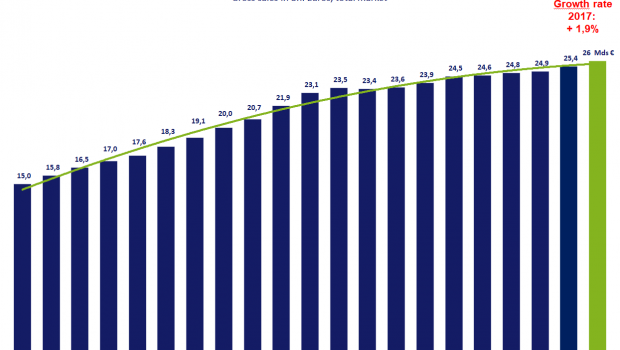

FMB president Frédéric Sambourg spoke of the "good results" of the DIY stores at the press conference. Having made improvements in terms of service, advice and multichannel retailing, the store chains now face another challenge: the local supplier concept and "conquering the inner cities". Unibal president Jean-Éric Riche commended the positive results "in a market that is undergoing a far-reaching transformation".

The economic landscape is viewed optimistically by the associations, especially with regard to the property market, because both new construction and the sale and refurbishment of existing properties have increased. This fact also explains the favourable situation in the building materials trade. In the market as a whole, product groups like flooring (+3.4 per cent), wood and construction elements (3.1 per cent), plumbing (3.0 per cent) and materials (2.9 per cent) have recorded above-average growth. However, electricals (-2.6 per cent) and paint (-2.4 per cent) experienced a decline.