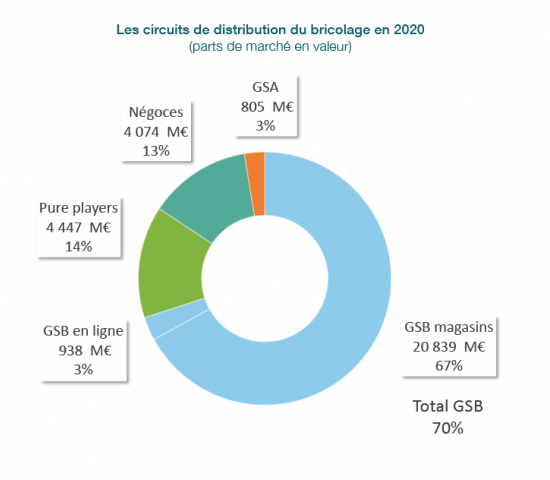

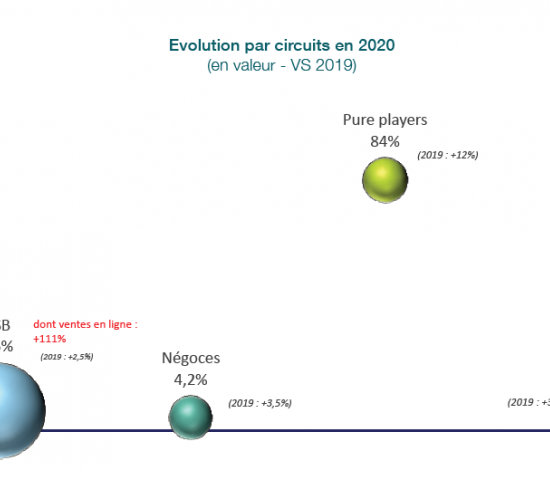

The growth in sales of the DIY stores was only half as great at 6.5 per cent, however, although the growth generated by their online business was 111 per cent. Bricks-and-mortar stores realised total sales worth EUR 20.839 bn, equivalent to a share of 67 per cent of the market. E-commerce sales came to EUR 938 mio, accounting for 3 per cent of the overall market.

The second-largest market share, namely 14 per cent or EUR 4.447 bn, belongs to the pure players in online retailing. As an overall segment they also enjoyed the highest growth with an increase of 84 per cent.

The speciality trade grew by 4.2 per cent to a sales volume of EUR 4.074 bn, finishing just behind the online retailers with a market share of 13 per cent. Despite growth of 7.7 per cent, the DIY category of the supermarkets continues to play a minor role, accounting for a market share of 3 per cent (EUR 805 mio).With regard to the market shares of the individual DIY store groups, any changes in 2020 were relatively small. Market leader Adeo (EUR 9.3 bn) fell by one percentage point to 43 per cent due to a decline of one percentage point in the share of its main distribution channel Leroy Merlin to 36 per cent (EUR 7.724 bn) (also Weldom and Bricoman). Kingfisher's share of 27 per cent (EUR 5.7 bn) remained the same (Castorama and Brico Dépôt). The three distribution channels of the Les Mousquetaires group (EUR 3.2 bn, Bricomarché, Bricocash, Bricorama, Batkor) gained one point and thus have a share of 15 per cent. Mr. Bricolage (including Les Birconautes) has retained a share of 8 per cent.

At the press conference, Inoha president Jean Luc Guery highlighted the good working relationship between retail and industry that had made it possible to weather the crisis so well. FMB president Mathieu Pivain spoke of unexpectedly strong growth, citing three particular effects of the pandemic that had caused this: finding new customers, especially younger ones, for whom DIY and gardening have become important; the fact that, driven by temporary store closures, online business has been strengthened in particular by the established chains with their stationary stores; and the growing importance of the concept of smaller, local stores, which were permitted to remain open in some cases.

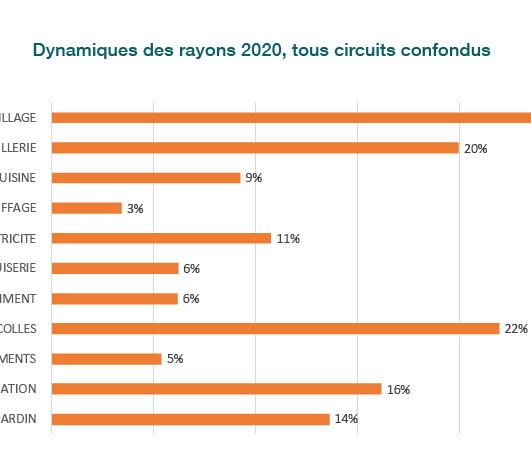

This analysis is underpinned not least by the figures for the product categories. Tools, for example, exhibit the highest growth rate at 28 per cent, paints and building chemistry are in second place with 22 per cent, both leading to the conclusion that a relatively large number of new DIY enthusiasts have emerged.

Figures were also presented for evaluating DIY store formats. Stores with a retail area of less than 4 000 m² experienced the highest growth both in total sales (11 per cent) and in sales per square metre (12 per cent). The big boxes covering over 10 000 m² saw increases of 4 and 8 per cent respectively. The poorest-performing stores were the medium-sized outlets, where the increase in sales per square metre of 3 per cent was even below the sales increase of 4 per cent.