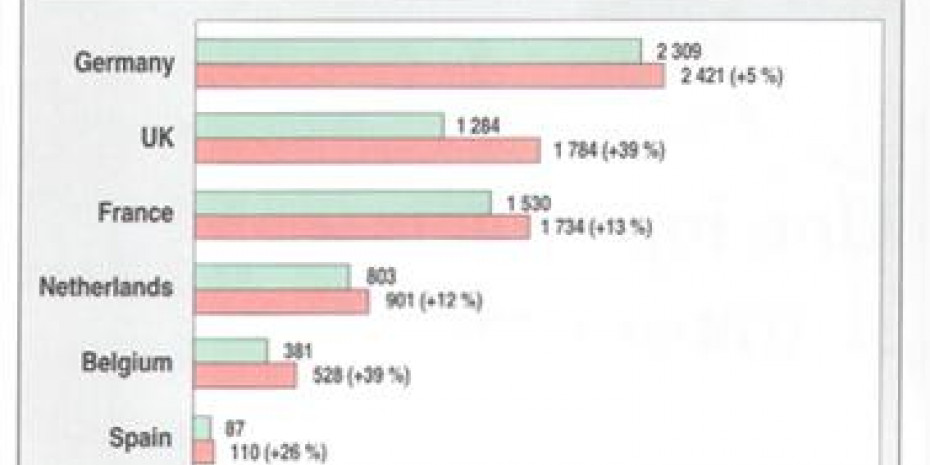

Although Germany is the most important market in terms of raw sales, at 11.5 per cent this segment was relatively insignificant as a proportion of total DIY sales in 1998.

In the countries under review, in 1998 private label had the highest penetration in the Netherlands with 32 per cent, followed by the United Kingdom with 24.6 per cent and Belgium with 24.4 per cent.

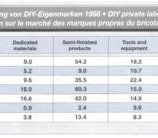

The status of private labels varies greatly according to product category and in part depends on the strength of certain brands in the particular sector. Of course it also depends on retailers’ readiness to invest in private label and on their presentation of the goods.

In the United Kingdom, which is the most highly developed private label market in Europe, many retailers have been generating strong private label brands for over a century. Consequently they are well established and highly respected in this country. On the other hand there are countries where private label development is very immature and where consumers have a low level of trust in the private label goods on offer. Here DIY retailers have a harder job establishing private label and would do better to introduce fantasy branding rather than to put the stores’ own labels onto products.

In the chemicals and paint category the highest private label penetration occurs in the UK, Belgium and the Netherlands. In these segments private labels account for over one third of value sales. This is because of the well-established nature of DIY multiples in these countries and also the high acceptance of private label goods by consumers.