deep insights, facts & figures

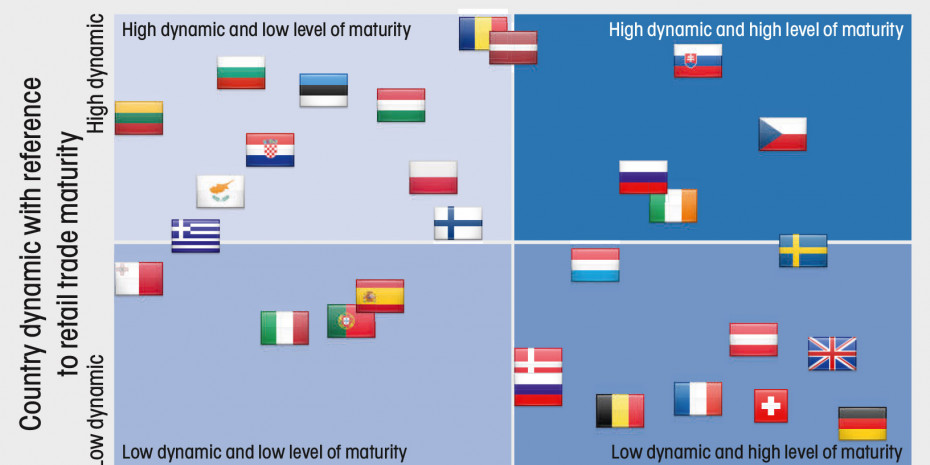

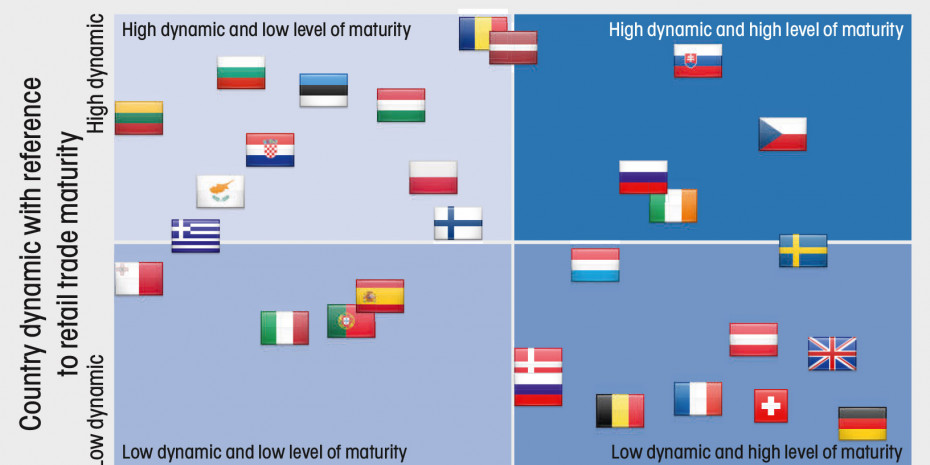

Level of maturity of the retail trade in Europe

The DIY stores and their ranges are being targeted even by players outside the sector. In Germany, a particularly fierce battle is being waged for customers

In the wake of the bankruptcy of German DIY chain Praktiker (including its second distribution line Max Bahr), reference has been made increasingly to issues such as "structural problems" or "structural weakness" in the DIY sector, especially in Germany.The fact is that sales amounting to around € 2 bn were lost to the sector in Germany with the demise of Praktiker AG. The DIY and home improvement stores succeeded in making up roughly 50 per cent of this deficit in the following year, 2014. However, projections to date suggest that sales by the end of 2015 will still fall short of the 2013 figure by roughly € 400 mio.This is by no means an unmistakable sign of structural problems; on the contrary, it is probably an expression of the ferocity of the competition. And that competition is coming from two directions. Of course, there is strong competition within the sector between the DIY and home improvement chains, but there is also competition from outside: category specialists in the speciality store mould, such as specialist garden centres, interior decoration stores, timber and builders' merchants and building component retailers are making life hard for the DIY store operators.The disappearance of Praktiker and Max Bahr has resulted in sales previously transacted in the sector shifting to these category specialists. In addition, some elements of the assortment are of interest to suppliers outside the sector, who have already expanded their marketing activities in individual categories relevant to the DIY stores.Thus online specialists (above all Amazon) along with furniture retailers, hypermarkets, tile stores, timber merchants and hardware and household goods retailers are carving out a growing share for themselves of a market worth around € 145 bn in total in the core assortments of the DIY and home improvement stores (DIY, building materials and garden ranges).By far the most important sales channel in these core assortments continues to be the resellers in the trade sector. The tradesmen currently account for around 61 per cent of market sales. If this sales element is taken out of the equation, then sales in the core assortments in Germany that are relevant to DIY retailers amount to around € 56 bn.

DIY and home improvement…

Related articles

Read also