A substantial trend towards consolidation should not be ignored, however, along with intensification of the competition. This plays into the hands of the major players; market leader Leroy Merlin, a subsidiary of the French Groupe Adeo, is gaining further market share in the soft DIY category in particular and pushing out its rivals.

This has resulted in casualties among Russian operators, with familiar DIY stores like Starik Khottabych, Iskrasoft, Stroyberry, Vistotch, Interieur and Intexo withdrawing from the market.

In the last year 65 operators have had to reduce their retail area by a total of 150 000 m² – nearly three times as much as in 2012. The three market leaders, on the other hand, expanded their retail area by almost 100 000 m², accounting for half of the overall increase of around 200 000 m².

Modern retail formats now account for more than 70 per cent of the Russian DIY market. The so-called open building materials stores and individual stores in the big cities make up roughly 20 per cent of the market, while the remaining ten per cent is attributed to individual timber yards in smaller towns, mostly belonging to timber processing factories.

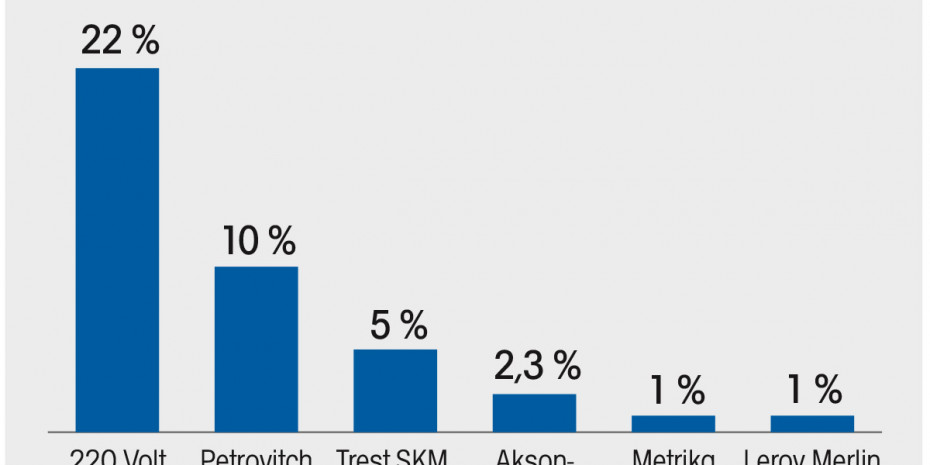

For its study “The Russian DIY Market. Results 2013. Forecasts up to 2017”, Infoline looked at 250 DIY store chains, which together account for a market share of 53 per cent. The study indicates that nothing has changed in the order of the top three: foreign store operators are well out in front, with Leroy Merlin head and shoulders above the rest.

The top ten achieved growth of 16 per cent with RUB 240 bn in sales and had over 300 stores with 1.45 mio m2 in retail area at the end of the year. They have thus consistently grown faster than the average. The 50 biggest DIY chains as a whole increased their sales by 12.9 per cent in 2013 to RUB 400 mio and have a market share in excess of 50 per cent. However, 27 of these grew more slowly than the market, thus below the average of 7.9 per cent. These companies include K-Rauta of…