Last year was anything but successful for the majority of German DIY multiples. However, despite everything there were more store openings than expected

Growth in retail area

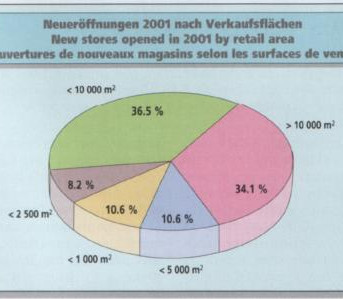

The tendency towards increasingly large retail areas, which has been noticeable for quite some time, was more clearly evinced among the newly opened stores in the year 2001 than ever before: 34.1 per cent of all new openings had a retail area in excess of 10 000 m2 (20.2 per cent in 2000). In contrast, a drop of 3 percentage points over the previous year to 36.5 per cent was noted for superstores in the size category from 5 000 m2 to 10 000 m2 of retail area. The share of stores from 2 500 m2 to 5 000 m2 has fallen once again (from 15.1 per cent in 2000 to 10.6 per cent in 2001). The percentage figure for all new openings last year in the category of stores below 1 000 m2 in size increased to 10.6 per cent (10.1 per cent in 2000).

The following picture emerges if all stores below 2 500 m2 are taken together: in 2000 a total of 25.2 per cent of all new openings belonged to this category, whereas in 2001 the figure was only 18.8 per cent. Not so many years ago there was indeed a far greater number of new stores opening, but today many more stores above 5 000 m2 in retail area are opened than in 1995, for example. At that time only 40.5 per cent of stores belonged to this category.

Multiples head the field

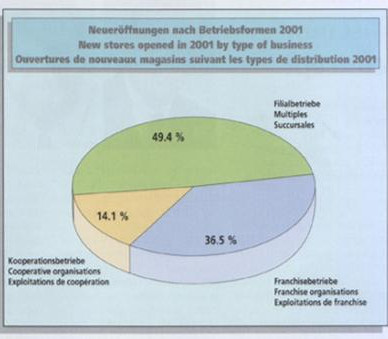

With 49.4 per cent of the total new openings in 2001 (47.9 per cent in 2000) the DIY multiples were the clear frontrunners, whereas the franchising operations suffered losses: their share dropped from 40.3 per cent in 2000 to 36.5 per cent in 2001. In comparison, the 11.8 per cent share claimed by the cooperatives in 2000 rose to 14.1 per cent in 2001. It may be presumed that the multiples will make up around 50 per cent of new openings in the future as well. The other half will be shared by franchising and cooperative businesses, whereby the franchising groups will on the whole keep ahead.

Expansion abroad

Expansion abroad has seen especially strong growth over recent years. In 1995 the German DIY store operators inaugurated only 3.4 per cent of all their new openings abroad, but just one year later this figure was as high as 10.9 per cent. The upward trend continued steadily in 1997 (14.3 per cent) and 1998 (22.8 per cent) as well. In the year 2000, 25.2 per cent of all new stores were opened abroad. That figure has now risen to 30.6 per cent. Mentioned as reasons for this development are sales growth rates ranging from high single-digit to double-digit figures, as well as positive contributions to results in certain countries.

Poor sales trend

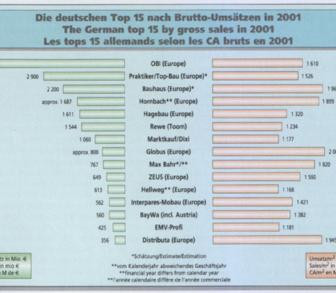

The aggregate turnover of the DIY and building stores in Germany for the first nine months of last year amounted to 12.73 bn euro, according to figures provided by the BHB. That is 1.2 per cent less than in the comparative period of the previous year. After adjustment the turnover remained 4.4 per cent below the nine-monthly figure for the year 2000. This means that the sales trend forecast for the year 2001 amounts to an increase of 0.3 per cent and, according to the BHB, that the DIY and building stores can expect an aggregate turnover of 16.97 bn euro. Almost all product categories suffered losses, with particularly marked setbacks for tiles at minus eight and occasional and self-assembly furniture at minus nine per cent. Building materials/chemicals and tools/machinery each lost four per cent, plumbing/heating three and electrical two per cent. Wallpaper/floor coverings/interior design and paint plus accessories remained on the same level. Slight gains were recorded by timber and plastics, which both grew by one per cent.

Kingfisher in Germany

Last year saw a number of changes within the DIY retail scene. In January Castorama announced the conversion of its German outlets into Casto-Depôt stores. In March Ratingen was the location for OBI’s introduction of its new concept for small retail areas called OBI-Fix, a convenience store as an alternative to the large-format version.

The biggest German garden centre multiple also entered new territory with the opening in November of the new “Blumenpark” with an affiliated DIY store at Dehner’s company headquarters in Rain. In the same month the DIY operator Hornbach took the opposite route when it opened a new combined garden and pet centre called “Lafiora”.

The recognised fact that Kingfisher has long had one eye on the German market resulted in numerous rumours of takeovers over the course of the year. Then in December the UK group succeeded in gaining a foothold in Germany through the acquisition of a 12.5 per cent stake in the equity capital of Hornbach. Strategic management is to remain in Hornbach hands, and agreement has been reached concerning coop-eration in day-to-day operations.