The second year of the coronavirus pandemic - the year 2021 - also left its mark on the turnover curves of DIY store operators in a market which can once again be described as turbulent. This becomes particularly clear from the rankings of the top 20 in Europe and worldwide. The editors of the online trade magazine DIY International have now published these rankings in their Statistics Home Improvement Retail Europe for the year 2021.

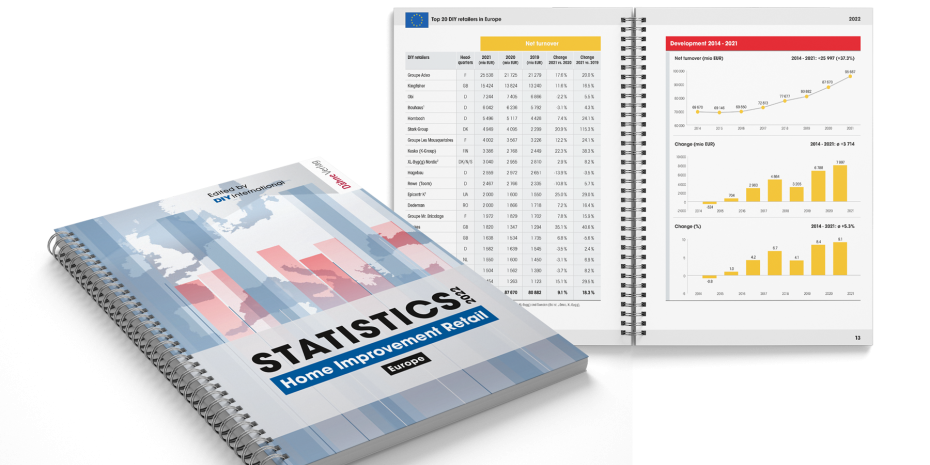

The turnover of the 20 largest DIY operators in Europe increased by 9.1 per cent to a total of EUR 95.667 bn. This was record growth, even compared with 2020, which already brought a plus of 8.4 per cent. Precisely because times are so turbulent, the research team at Dähne Verlag thought it appropriate to include a comparison with the pre-coronavirus year 2019. The 2021 plus then amounts to 18.3 per cent.

However, the two-year comparison is particularly interesting with regard to the individual companies, which were exposed to different coronavirus restrictions in their home countries as well as in their respective foreign markets. This becomes particularly clear in the case of the six German representatives in the club of the 20 largest operators. Obi, Bauhaus, Hagebau, Rewe/Toom and Globus had a lower turnover in 2021 than in 2020, primarily due to the lockdown in Germany at the beginning of 2021 and the record turnover in 2020. Only Hornbach shone in 2021 also with a plus of 7.4 per cent. The growth rates of the Germans compared with 2019 are correspondingly low when set alongside most of their European colleagues, while Hornbach stands out here, too.

The situation at the head of the Top 20 in Europe has stabilised. Market leader Adeo took another big step forward with a sales increase of 17.6 per cent compared with 2020. The gap to the industry runner-up Kingfisher, which grew by 11.6 per cent, is more than EUR 10 bn in total sales for the first time.

This is just one example of the wealth of data that the Statistics reference work once again offers in this new 2022 edition. In addition to the European operators, there is also a top 20 ranking by turnover, sales area and number of locations for the worldwide DIY market.

The country presentations are once more at the core of the statistics. For 34 European countries, the reference work shows the DIY operators with their number of stores and retail areas. Two large matrix presentations show the involvement of the European and non-European DIY store groups in their respective…