The same number of cash registers were operating in 565 000 outlets in 2013, which works out at an average of 1.8 cash registers per outlet. The increase in the average number of cash registers per outlet is explained by the growth in retail area and the decline of smaller shops.

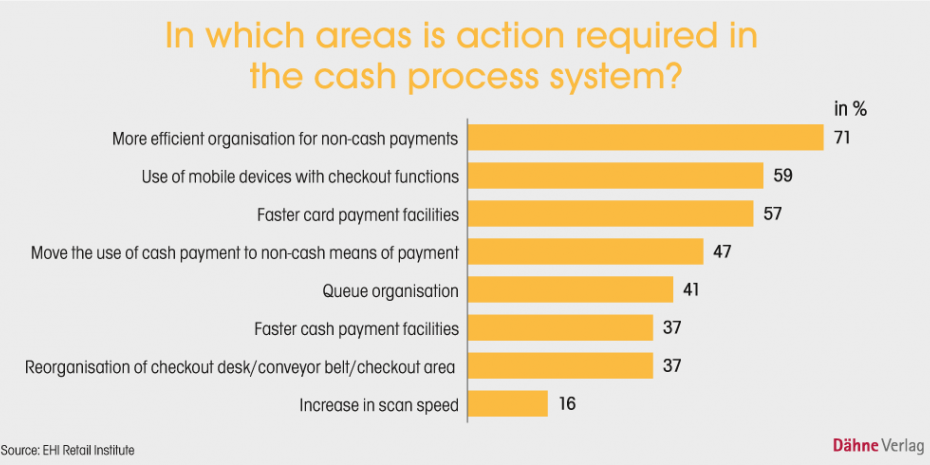

When asked about the potential for optimisation of the cash register process, the decision-makers see major room for improvement above all in the more efficient handling of cashless payment methods. Specifically, 57 percent of those surveyed with POS responsibility expressed dissatisfaction with the speed of card payments, and yet retailers are striving to increase the proportion of cashless payments further. Survey respondents are hoping that mobile and contactless payment methods will bring about substantial improvements in the future.

The calculated average age of cash register hardware has not changed compared with 2012 and remains at 5.4 years. The average service life of cash register software is roughly seven years. 37 per cent of the companies surveyed intend to renew their cash register software in the next two years.

The significance of the touchscreen as an input medium continues to grow beyond sector boundaries. Even lines of business that were previously sceptical increasingly perceive advantages compared with the keyboard. 93 per cent of the companies on the panel plan to use touchscreens in the future. 65 per cent will also even dispense with a back-up keyboard. In many cases the use of expanded functions of the touchscreen such as gesture control is also being considered.

15 per cent of companies (2012: nine per cent) indicate that the design of the cash register is a deciding factor in the choice of cash register hardware. This point plays an important role in selection for a further 57 per cent.