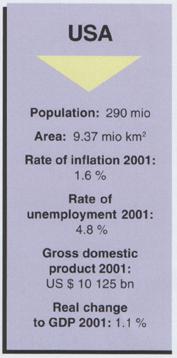

Since last year the hardware/home centre industry in the United States has been doing remarkably well in contrast to the general economic trend

Home Depot is recently focusing on smaller neighbourhood stores.

Sales of homes are continuing to hold up very well. Low interest rates make buying a home of your own very affordable. Stable prices encourage consumers to spend their money. In fact, spending by private households has been propping up the American economy during the past two years even as unemployment increased. A drop in unemployment in the last several months is being regarded as a positive sign for future growth. Home ownership is now reaching the 70 per cent mark, so there are plenty of homes to modernise, gardens to create and care for, patios to build and furnish. What all this means is that hardware and home improvement retailing is unlikely to show any slowdown in expansions and growth in the coming year. The market will continue to be dominated by the two industry giants, Home Depot and Lowe’s.

While most attention does tend to be focused on Home Depot and Lowe’s, there are other important channels as well. These include the mass merchant channel, for example, which will probably become a two-chain industry in the future, just Wal-Mart and Target, as the third, Kmart, battles its way through voluntary bankruptcy. Often overlooked are the dollar stores, which offer lower priced brands or low priced unbranded products. Their assortments are not broad, but they meet the basic needs of many families.

(pdf download)

Home Depot exploring new concepts

Home Depot opened its 1 400th store recently and is actively exploring new concepts as it finds that it has quite thoroughly saturated most major metropolitan markets with its big boxes. This is why the company has developed a neighbourhood store concept to enable it to reach deep into urbanised centres. The first store of this kind opened in Brooklyn, NY, in late spring 2002, and others are being opened on a regular basis. These outlets offer few, if any, building materials. The four experimental Villager’s Hardware stores have been converted into urban Home Depots.

Another strategy involves targeting a broader range of customers. To this end the company aims to attract professionals such as small contractors and tradesmen. Home Depot offers them pro-specific product assortments, credit programmes and enhanced delivery services, as well as a special desk staffed by more qualified staff. At the end of 2001 more than 500 stores offered these features, and another 400 stores will be added this year. Home Depot says that 30 per cent of its business currently comes from this type of customer.

The company is also experimenting with specialised stores serving the flooring market and even speciality wholesaling. It is expanding its installation services to better serve the “buy-it-yourself” market. Here it has only two per cent of the market, which it sees as a considerable growth opportunity. One of its best known speciality chain ventures is the Expo Design Centers, geared to high income customers who are willing to spend a great deal on remodelling projects. However, under the new management the expansion rate for these stores is progressing more slowly.

Under its new chairman and CEO Bob Nardelli, formerly of General Electric, the company is focused on improving employee and store productivity rather than headlong growth in new store units.

Speculation continues about Depot’s eventual move into Europe, but Nardelli seems to feel that these other expansionist avenues better exploit the company’s existing expertise. Its withdrawal from Chile and Argentina proves that the company cannot successfully export the existing concept. Depot stores are very successful in Canada and Puerto Rico, but those markets are very like that of the US. It is still too soon to evaluate its recent purchase of a small chain in Mexico.

Their well-kept appearance makes Lowes’s stores particularly attractive to women.

Well-kept appearance

Meanwhile second-ranked Lowe’s, which has only half as many outlets as Home Depot, says it sees many new markets for its expansionary plans. The Lowe’s stores are clean and friendly, which makes them more attractive to female customers. What is more, its strong position in household appliances (No. 2 in sales) increases its appeal to women as well. And while Lowe’s does operate a warehouse format, its stores feature good signing and are tidy and uncluttered. In its newer stores Home Depot is moving towards this well-kept look.

Lowe’s is planning 123 new openings in 2002, with 65 per cent of the total destined for metropolitan areas. The company now operates in 44 states, but has fewer than 10 stores in 19 states and fewer than five stores in nine.

(pdf download)

Menards the growth machine

The third largest home improvement chain, Menards, is a privately-owned company which is proving that it can compete effectively against both Home Depot and Lowe’s. Its sales are estimated to be nearly US $ 5 bn, giving it enough purchasing power to be able to offer competitive prices. The Menards stores are huge “big boxes”, but merchandised with gondola fixtures in the front half to two thirds of the store. Warehouse-style fixtures are used only in the back of these brightly lit, friendly stores, where bulky goods are stocked and sold. The floors are tiled and kept immaculately clean, instead of the bare concrete found in Home Depot and Lowe’s. Unquestionably, this format is more appealing to women.

Ace Hardware is positioning itself as the No. 1 cooperative in the USA and worldwide.

Strong support from cooperatives

With the top three DIY retailers planning continual store openings and aggressive growth, what is happening to the rest of the industry?

Smaller chains and independents rely on their employees to help them compete. They mainly work full-time and consequently regard their jobs as careers, in contrast to the part-timers employed by the big chains. Their superior training also enables them to offer better customer service. The smaller chains and independents are primarily supplied by cooperatives, which allows them to compete against the giants. Within the wholesale field, Ace Hardware has replaced Tru Serv as the largest wholesale firm in the United States and the world, with sales of US $ 2.89 bn. Do It Best quite likely will become No. 2 by the end of this year, inasmuch as it is growing at a faster rate than Tru Serv, which is beset by a variety of problems. The privately owned Orgill Bros. continues its substantial growth, mainly through acquisitions, and now has sales exceeding US $ 500 mio.

Those four wholesalers, as well as others belonging to merchandising groups like Pro Hardware and Distribution America, offer their customers many special services such as store design, consumer promotions and even guidelines on how to compete against the big chains. The result is that smaller retailers feel more confident in their ability to compete and the store count appears to have stabilised.

DIY in Europe 8/2002