Lower real estate prices are leading US retailers to take a more casual attitude to their shelf planning, but their sophisticated data infrastructure gives them more options regarding price management than their European colleagues. That is the view of Sheri Raznick, vice-president of global delivery at Revionics, Inc. She explains the key criteria in an interview.

Concerning the optimisation of store space, is there room for improvement when it comes to American DIY retailers? Where and why? What are the most common mistakes?

Sheri Raznick: It's safe to say that virtually every retailer, including American DIY retailers, is over-assorted in the store. Particularly with real estate being relatively less expensive and more abundant in the US than in Europe, retailers may be a little less vigilant about how efficiently they use floor space. A good step is to better leverage their online channels' "endless aisle" to offer items that they wouldn't need to stock in the store. Additionally, it pays to use science-based pricing and demand forecasting to accurately drive shelf sets and avoid being in an overstock or out-of-stock condition.The good news is that today's sophisticated shoppers are tolerant of reasonable differentials between in-store and online pricing and of retailers leveraging science to set prices. In a recent survey of shoppers in the US, UK, Germany, France and Brazil, a Revionics-commissioned study by Forrester Consulting asked about whether they expected prices to be higher, lower or the same online versus in the store, and the majority expected higher in-store prices across the board (except in the grocery sector). Moreover, fully 78 per cent of shoppers said they are comfortable with the use of machine-learning data science to set pricing, trusting data science more than retailers to set fair prices.*

Which product categories do American home improvement retailers overestimate, which do they underestimate?

Consumer tastes and home decorating trends evolve very quickly so it is difficult to make generalisations. Again, DIY retailers would be well-served by doing in-depth analytics to truly understand what are their real key value items (KVIs) - and which are not! - so they can target and price their assortments accordingly. We do observe that in the US, DIY retailers tend to go deeper into home electronics and appliances whereas in Europe it is more pure-play construction materials, while home appliances are often only available at appliance/electronics retailers.

Compared to other retail segments, do DIY retailers really know their customers? Which target groups do they neglect?

DIY focuses on contractors, often business customers, and home owners or renters doing their own improvement projects - a very bifurcated audience. There are distinct value propositions between contractor and DIY homeowners, so DIY retailers need to craft prices, promotions and loyalty programmes that target each customer set distinctly. Contractors have more immediate needs based on their current projects so they are less likely to wait for a promotion - in that sense they are almost everyday low price focused. Loyalty programmes for the professional customers are also structured for, say, volume incentives. In contrast, homeowners are more likely to respond to promotions/offers and would have a loyalty programme more similar to those of other B2C retail sectors.The growing importance of online channels impacts both the B2C and B2B DIY customers. DIY markets within Europe vary substantially by country - whether people own versus rent their homes, economic health (people do more DIY when the economy is challenging versus paying a contractor in better times), average size of construction and remodel companies, and whether contractors are individual entrepreneurs versus large construction companies. Relative to other retail sectors, DIY tends to be highly consolidated, with just a handful of players dominating the market in any given country. In both markets individuals pay a different price than a contractor and construction companies often have a separate price list altogether. Provide targeted offerings like ability to rent a van or truck for DIY consumers.Contractors/business customers may come in several times a week and their shopping needs reflect their customer's requirements. The private homeowner or renter shops relatively sporadically so it is not as easy to predict their shopping patterns. DIY retailers need to leverage science that can tune algorithms according to specific customer segments.

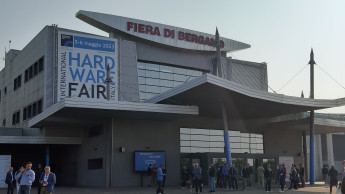

It worked

For Italy, for Europe and beyond – this is how Koelnmesse conceived the new International Hardware Fair Italy in Bergamo. The first edition has fulfilled all expectations

Compared to other countries, are American DIY retailers good at price management?

In general, US retailers are fairly advanced in their adoption of price management and price optimisation compared to their peers elsewhere. That said, in our experience European and Latin American DIY retailers tend to be as aware as their US counterparts of the concepts and value of a science-based approach, but in general they may not have as sophisticated a data and IT infrastructure.The US also seems to be more aggressive in providing private-label offerings in their assortment than their European counterparts. This makes it more challenging for competitors and shoppers to do exact price comparison and price-matching in the US.*Understanding Retail Customers' Pricing Expectations and Tolerances,a May 2017 commissioned study conducted by Forrester Consultingon behalf of Revionics

Contractors have long been a key customer category for DIY retailers.

In the US, DIY retailers tend to go deeper into home electronics and appliances.