When the UK went into lockdown, the major DIY retailers were permitted to stay open for the sale of 'essential goods' but opted to close stores to allow them to develop safe operating practices for staff and customers. Their online shops remained open, and some offered click & collect from their car parks. By mid-May all the DIY chains had reopened stores, even if some in-store services remained unavailable. Garden centres, which had been forced to close, were allowed to re-open on May 13th. With consumers stuck at home during fine weather, retailers and suppliers were faced with the challenge of fulfilling strong demand for many products.

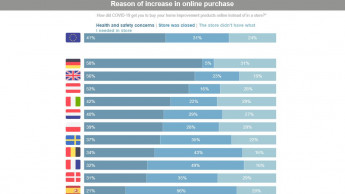

The switch from shopping in store to online is clear. In April B&Q's sales were -43.0 per cent, yet Kingfisher's e-commerce sales were +251 per cent. More generally, the Office for National Statistics (ONS) reported in April a record participation of online sales of 31 per cent (19 per cent in April 2019). Popular product categories were garden-related, smaller indoor projects and home office equipment. These trends will continue after lockdown is eased as people have seen the benefits of working from (and enjoying) their homes. And younger generations have turned to DIY and gardening, many for the first time.

The unknown is the economic impact on consumers. How deep and long will a recession be, and how will it impact on house prices (an important driver of DIY spend)? While some consumer segments have been relatively unaffected financially (e.g. older age groups with generous pensions), the increases in unemployment, that typically impact younger age groups, are likely to continue. Spend on 'big ticket' items will be hit.

Risk of Coronavirus infection in DIY stores is as low as in the open air

In DIY stores, the risk of a Covid-19 infection is similar to that of outdoors. This has now been confirmed…

Giving customers confidence to shop in store remains critical and a potential differentiator. And as online shopping accelerates, retailers will need to increase digital investments to offer a smoother online shopping experience. The increased investment will test economic models. There may be further store closures, given lower footfall and higher operating costs. The economics of home delivery will also impact on profitability. Those with the continuous sales from trade customers will have an advantage.

The impact on suppliers has also been far-reaching, putting a strain…