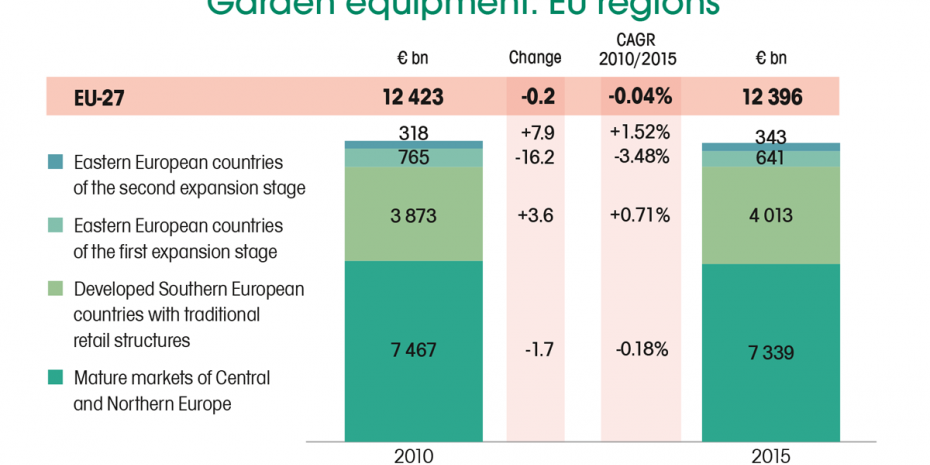

The report estimates the market volume in the European Union (27 countries, without Croatia, who only joined in 2013) at € 12 396 bn for the year 2015. That is a respectable five per cent more than 2014 - but not more than five years before (0.2 per cent less). From 2010 to 2015 the average annual growth rate lay at -0.04 per cent. Which means: no growth, only stagnation.

Only two out of the four regions showed an increase: in the developed southern countries with traditional retail structures, the average growth lay at 0.71 per cent with a most recent € 4.013 bn. And in the Eastern European countries, in a second phase of expansion, average annual growth rates were determined at 1.52 per cent - however only with a very small volume of a mere € 343 mio. In the region with the largest market volume, the mature markets in Central and Northern Europe, garden equipment and decoration sold 0.18 per cent less, year for year, between 2010 and 2015.

The fact that three of the top five had growth rates of over three per cent between 2010 and 2015 prevented the total European market from dropping. Italy grew in these five years by 3.5 per cent, Great Britain by 6.9 per cent and Spain even grew by 8.6 per cent. The total EU-27 figures were pulled down, for instance, by the two other top three markets: in Germany it was -4.4 per…